India and the United Kingdom have signed a landmark Free Trade

Agreement (FTA), marking a major step forward for the world’s

fifth and sixth largest economies. This agreement is expected to

enhance bilateral trade, investment, and economic cooperation

between the two nations.

The FTA is projected to boost annual bilateral trade by £25.5

billion, increase UK GDP by £4.8 billion, and raise wages by £2.2

billion in the long term. In 2024, total UK exports to India stood at

£17.1 billion, while imports from India reached £25.5 billion,

mak...

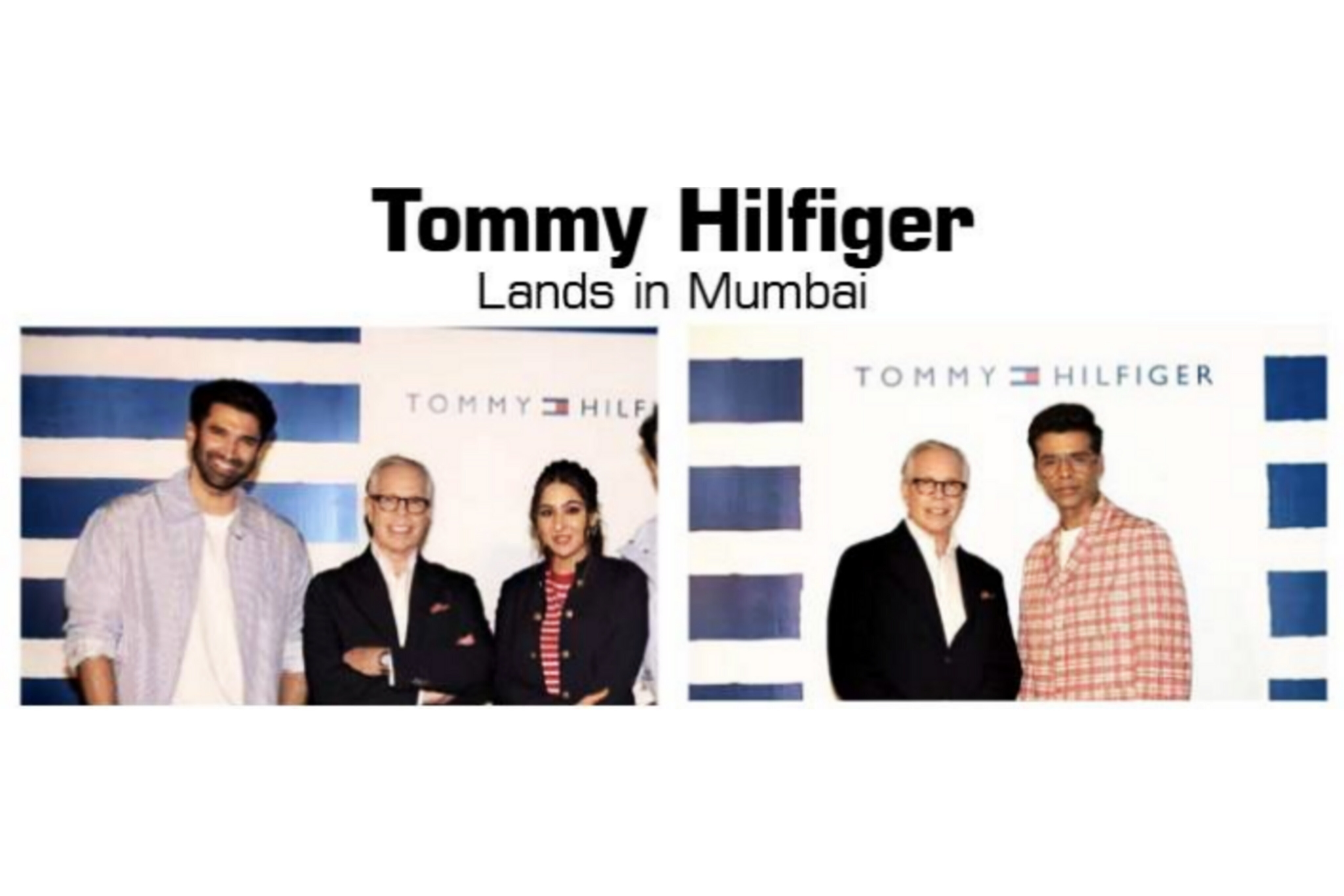

Tommy Hilfiger, which is part of PVH Corp., announces

Mr. Tommy Hilfiger’s visit to Mumbai, India, for a

vibrant day of fashion, cultural exchange, and connection – reinforcing the brand’s presence in one of the world’s

most ...